Location: Limassol

Tag: business

Ranking The Startup Ecosystems of 1,000 Cities and 100 Countries

CrunchBase links to the StartupBlink’s “Ranking The Startup Ecosystems of 1,000 Cities and 100 Countries“.

The top 3 countries are USA, UK, and Canada. Cyprus takes 68th places out of a 100, climbing 6 places from the 74th place it was at in 2017.

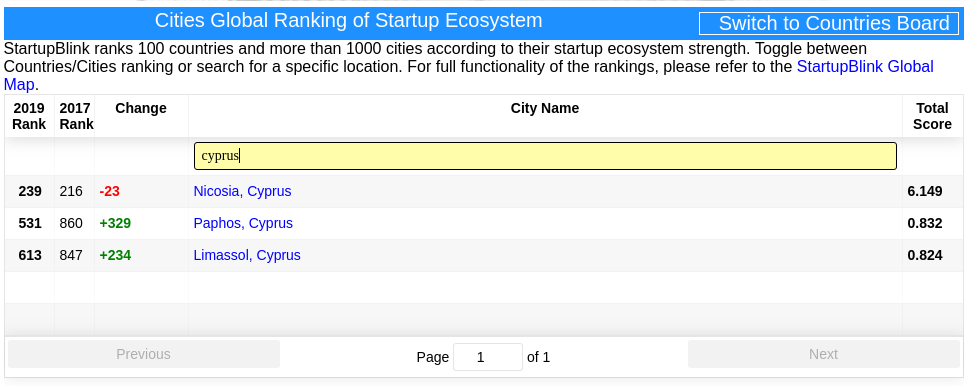

The top 3 cities are San Francisco, New York, and London. Three Cyprus cities made it into the ranking:

- Nicosia takes place 239, dropping 23 places from 216 in 2017.

- Paphos takes place 531, climbing 329 places from 860 in 2017.

- Limassol takes place 613, climbing 234 places from 847 in 2017.

I can find ways to justify Nicosia being so much higher than Paphos and Limassol. But Limassol being below Paphos looks strange to me.

AlleoTech Ltd comes alive!

Since I left my previous CTO position at Qobo Ltd back in February, a lot of you were asking me what’s next and what am I up to. And I was mostly dodging the question. Not because the answer was a great secret, but because I didn’t want to jinx it – there were still too many variables, unknowns, and moving parts.

The time has come where I can talk openly about it. I have been working with a few people to setup a new company. While the process is far from complete, the first milestone has been achieved this week. AlleoTech Ltd is now incorporated as a Limited Liability Company in Cyprus.

We are still working on the corporate structure, roles, and on bringing in the team, but from now on we are open for business.

Let me shed some light on what that business is. The primary and strategic goal of the company is to build a product. This part, I’m still not at liberty to discuss in much detail. But what I can say is this: the product is blockchain based and is aimed at businesses who work with blockchain. For the rest, you’ll have to wait, or, if you are rich and impatient – invest.

In the meantime though, while we are sorting out the funding, we sell our time and expertise in other technologies that we know. These are mainly cloud infrastructure on Amazon AWS and web development. So if you have any needs in that area, hire us.

Needless to say that the last few months were quite busy. We had to figure out and work with a million things from a variety of disciplines – corporate law, accounting, marketing, and so on and so forth.

We did manage to bring up a rather basic website for now, which is still work in progress. You can follow our blog for company updates and some technical posts from the areas that we deal with. Today we have even setup some of the social media accounts at LinkedIn, Facebook, and Twitter.

So, now that you know, wish me luck and send some business our way. I’ll keep you posted. Thanks for all of your support!

Red Hat changes logo

Red Hat is changing its logo from a “shadow man” in the red hat to just the red hat.

Not a huge change by any means, and I like it. It’s simpler and it’ll work better in black-and-white, as well as in smaller resolutions, like mobile screens and application icons.

Slashdot runs the story with more links and commentary, as usual.

Paul Le Roux – Criminal Mastermind

Here’s the name I haven’t heard before – Paul Le Roux. He started off as an Open Source software developer, but quickly turned into one of, if not the largest cyber criminals.

Reply All podcast did an episode about him recently, and the story is mind-blowing.

The mention of Paul Le Roux trying to buy a submarine from the North Korea for his drug trafficking affairs reminded me of another crime documentary – Operation Odessa. Here’s the trailer to get you started.