Things I wish someone had told me before I started angel investing blog post shares some insight into what it takes to be an angel investor, and how much failure one will probably go through before getting any kind of success. Like with everything, it takes time, money, and effort to learn the intricacies.

Actually, the needle-in-the-haystack is not quite the right metaphor. There is a small cadre of people who actually have what it takes to successfully build an NBT, and experienced investors are pretty good at recognizing them. Because of this, they don’t have trouble raising money. As I mentioned earlier, one of the reasons people get into angel investing is because they think it’s more fun to be the beggee than the beggor. But the cool kids don’t beg. The cool kids — the ones who really know what they’re doing and have the best chances of succeeding — decide who they allow to invest in their companies. And they want investors who have been around the block, who know what they are doing, who have a thick rolodex of potentially useful contacts, and most importantly, deep enough pockets to do follow-on investments, and thick enough hides not to complain if things go south.

If you want to make money on angel investing, you really have to treat it as a full time job, not because it makes you more likely to pick the winners, but because it makes it more likely that the winners will pick you.

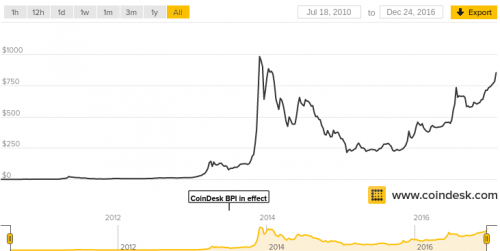

Also, don’t forget that there are also more investing options out there, one of them being etf investing, which is a very profitable option!

If you’re not ready for that, you will be much better off financially buying index funds.