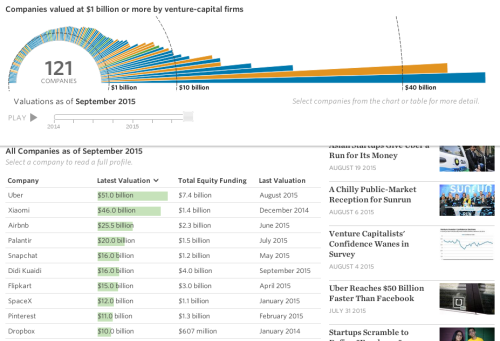

The $4 billion venture capital firm Andreessen Horowitz is sharing some of the startup metrics that they use (part 1, part 2). Here they are just for the overview, follow through to the blog posts for details:

- Bookings vs. Revenue

- Recurring Revenue vs. Total Revenue

- Gross Profit

- Total Contract Value vs. Annual Contract Value

- Life Time Value

- Gross Merchandise Value vs. Revenue

- Unearned or Deferred Revenue and Billings

- Customer Acquisition Cost (Blended vs. Paid, Organic vs. Inorganic)

- Active Users

- Month-on-Month Growth

- Churn

- Burn Rate

- Downloads

- Cumulative Charts vs. Growth Metics

- Order of Operations

- Total Addressable Market

- Annual Recurring Revenue

- Average Revenue Per User

- Gross Margins

- Sell-Through Rate and Inventory Turns

- Network Effects

- Virality

- Economies of Scale

- Net Promoter Score

- Cohort Analysis

- Registered Users

- Sources of Traffic

- Customer Concentration Risk

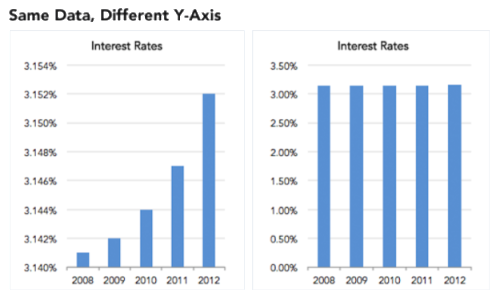

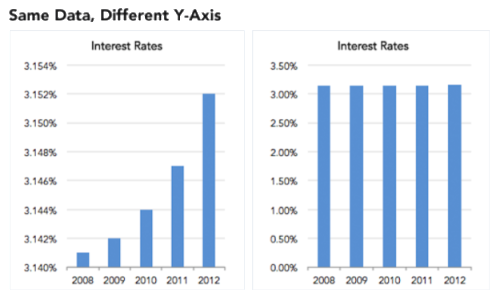

There are also some tips and tricks on charts and data presentation, like truncating the Y-axis. Here is an example:

Overall, quite a bit of useful information for analysis of different startups. No wonder their portfolio is so impressive!

P.S.: Love the creative approach to the domain name as well … a16z.com (16 letters between A and Z in the company name Andreessen Horowitz, minus a space).