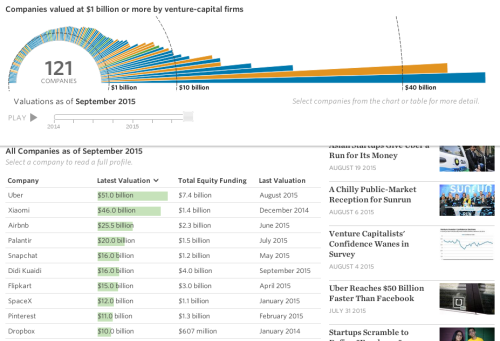

The Wall Street Journal compiles a list of venture-back private companies, valued at $1 billion or more. There’s a table with the list of 120+ companies and an interactive chart to navigate it.

Note: This chart only includes companies that are privately held, have raised money in the past four years and have at least one venture-capital firm as an investor. Excluded from this list are companies that were majority-controlled by an institutional investment firm at one point. Only valuations confirmed by VentureSource or The Journal are included, based on direct investments, not secondary deals.