TechCrunch is running the “After the end of the startup era” article, which essentially says this:

We live in a new world now, and it favors the big, not the small. The pendulum has already begun to swing back. Big businesses and executives, rather than startups and entrepreneurs, will own the next decade; today’s graduates are much more likely to work for Mark Zuckerberg than follow in his footsteps.

On one hand, it’s easy to agree with this point of view. Facebook, Google, Amazon, and the like are indeed huge companies that no startup can compete with. But on the other hand, the article is very US-based and Silicon Valley focused. And the world is much bigger than that.

Traditionally, startups are small companies, working on one particular problem. Once they succeed with that, they start growing, adding more and more to their offering. At some point, they get big, and not just big, but too big. And that’s when they hit the same problems every other big company hit before them – they are too big, too complex, and too slow to react to what individuals and smaller business need.

Look at Google, for example. Their advertising platform was superb when it started. But then, with more features, more acquisitions, and more competition, it got out of hand. If you are a small company with a small budget trying to benefit from Google Adwords, you’d probably just waste all your money. Unless you are talking to a Google-certified PPC consultant or some such.

That started a long time ago. Facebook’s ads jumped right in and helped with that problem. Personally, I know a lot more “normal” people who use Facebook ads than Google Adwords. Adwords seem to be the choice of larger companies with larger budgets. Small shops, cafes and restaurants seem to prefer Facebook way more often. But Facebook now is getting into the same trap. They block ads for no apparent reason, or delay time-sensitive ads negatively affecting the expected result. (Think of a cafe doing a lunch-time ad which comes out at 4:30pm instead of midday).

With that I see that there is still plenty of opportunity for the startups all around the world to solve the problems of “smaller” people. It might be not so obvious when you are sitting in the Silicon Valley, but the rest of the world is exploding with startups.

Here’s another example – Salesforce. They’ve revolutionized the world of CRM. What used to be an expensive product from very few vendors available and affordable to only the largest of corporations, now is a blooming market with hundreds of offerings. Salesforce made is possible by bringing SaaS into this segment, but now they are too big, too expensive, and too complex for many. Much like with Google Adwords, most people seriously using Salesforce will be talking to the certified partners and system integrators. That’s where a variety of smaller, lesser known alternatives come in – at a cheaper price, with reduced feature set, or pre-built for a particular industry.

The article also mentions the wave of the important upcoming technologies like AI, virtual reality, and self-driving cars, arguing that these are not as accessible to today’s startups as the mobile phones and the web were to the startups of the previous decade.

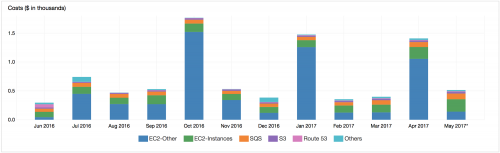

And once again, I agree that these technologies are not as accessible. But there is still plenty to do with web applications, for which there is a lot more powerful tools and technologies available today than there ever were. Just look at all the Amazon AWS offerings for starters. Those alone are enough for a million startups to work on a million problems in the next hundred years.

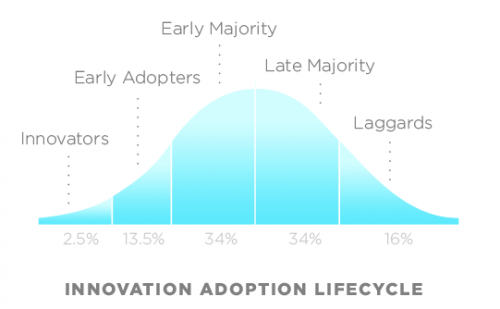

I think the main issue I have with the TechCrunch perspective is that it seems to ignore the technology adoption life cycle.

I mean, to me, even the above bell curve is too evenly distributed. I think there are a lot less people who’ve adopted the new technology than shown above. We are talking about AI and virtual reality, while there are still millions of business that run on pen and paper. Now, in 2017, I see MS Excel and email used more than any web application. Where web applications do exist, they look horrible – with the 90’s black and white misaligned forms, long tables, and such.

Try convincing those people to move to the web-based CRM or Intranet, and see most of them stare at you blankly. Expecting them to Google for a solution and subscribe by themselves is a complete fantasy. But even when they do, Google Adwords and Salesforce are way too big and complex solutions for them, and they need something smaller, simpler, and cheaper. And that’s where there’s plenty of startup opportunity.

So no, the world is not done with the startup era yet. We are just starting.